HomeReady ‘s the identity away from Fannie Mae’s step three% downpayment mortgage. Its a reasonable home loan program for basic-big date home buyers that is and available to repeat people and you can present people to own refinance.

Fannie mae revealed HomeReady inside 2014. The applying replaced new agency’s MyCommunity Financial program, that was limiting and you may restricting. HomeReady composed brand new, flexible, sensible homeownership options for lower- and you can modest-money people; permits having at least down payment of step three% and you may subsidizes financial prices and financing will set you back.

Who’s eligible for the brand new Federal national mortgage association HomeReady home loan?

- You need to undertake the home you happen to be financing. HomeReady is actually for top homes just. Home buyers can’t make use of it to finance a vacation domestic, Airbnb property or other sort of investment property. Co-signers are allowed, and at least one individual listed on the home loan need real time about property.

- Your property must be a house. HomeReady is for affixed or detached unmarried-family relations houses, as well as townhomes, condos, rowhomes and you may multiple-equipment house regarding four equipment or less. Are formulated land is eligiblemercial services are not allowed.

- Your own financial need certainly to fulfill conforming financial guidelines. HomeReady try a federal national mortgage association home loan program, which means that loans need meet Fannie Mae’s conforming mortgage assistance. Loan products should be in this local conforming financing limitations, buyers should provide proof earnings and loans can not be notice-simply.

- The down-payment must be at the least step three%. HomeReady allows that loan-to-really worth (LTV) doing 97 % of your own price. Customers need to create the very least step 3% down payment, that may come from one eligible source. Qualified offer include regulators down-payment guidance software, cash merchandise out-of family members or family unit members, cash has and money.

- Your income must be unhealthy to suit your census tract. House earnings getting HomeReady people might not go beyond eighty per cent regarding the fresh median family money regarding residence’s census area. Home buyers exactly who earn too much money to possess HomeReady have access to almost every other low down payment money, for instance the Conventional 97 system and also the FHA step three.5% down-payment home loan.

- You will possibly not are obligated to pay money on multiple other mortgaged family. HomeReady lets home buyers to have a monetary interest in one most other mortgaged possessions, which are a holiday family, short-term rental possessions otherwise a good investment. There are no limits towards the commercial possessions opportunities.

- You really must have a credit rating off 620 or higher. HomeReady demands at least credit rating out-of 620 for 1-device and you may multi-equipment residential property. Fannie mae spends the newest FICO credit scoring program, and therefore ignores medical financial obligation and you can series.

- You ought to sit-in an effective homeownership education class. Federal national mortgage association means earliest-day homeowners doing good homeownership education path as part of a great HomeReady approval. The loan institution offers an on-line academic course entitled HomeView at the totally free. Homeownership degree reduces mortgage default chance by the 42%.

HomeReady income limits

Federal national mortgage association composed HomeReady within the 2014 to aid lowest- and average-money tenants get to its American Dream of homeownership, in which reduced-to-reasonable income is understood to be getting less yearly money than just your closest natives.

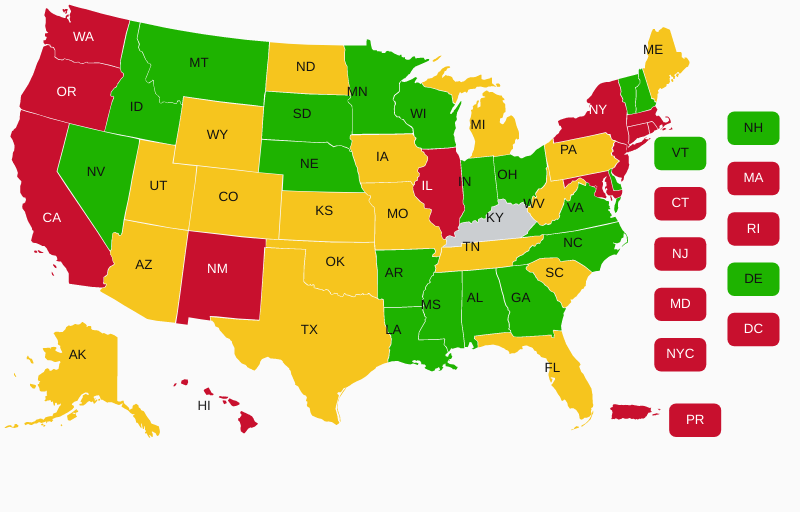

HomeReady homebuyers may well not earn more than just 80% of its the fresh new house’s census tract’s income. Federal national mortgage association can make money restrictions on the webpages given that shown lower than.

HomeReady may be used inside urban area, suburban and you will outlying parts. It lowers deposit conditions to three%, drops mortgage cost so you can more affordable levels, and you may makes no credit check personal loans in Arkansas home ownership minimal, smaller and much easier.

HomeReady, accessory dwelling gadgets (ADU) and you can boarder money

Whenever Fannie mae first launched its HomeReady home loan in 2014, the fresh new agency said the program because the home financing to have multiple-generational houses. They enabled boarder money of moms and dads, grandparents, and college students, all of the way of living in one place and you can contributing to monthly obligations.

The program offered several years afterwards so that attachment hold gadgets (ADU). An item tool was a location with a cooking area and a good toilet inside a different house, constantly featuring its individual access. Attachment gadgets can be about basement, above the driveway otherwise attached to the subject property. ADUs can certainly be independent home into property away from a keen current assets.

With boarder money, people may use money obtained, money-for-dollars, as the income to your the loan. Proof of commission shall be in the form of canceled monitors, Venmo or any other electronic transmits, or bank comments appearing dumps into a checking account.

Income out-of connection hold devices can not be put dollar-for-dollar as earnings towards the an application. Lenders usually subtract 25% from lease accumulated towards the an ADU so you can be the cause of openings and you may will set you back. Homebuyers try recommended, although not needed, to make use of signed book arrangements indicating their rental earnings.

HomeReady mortgage prices and mortgage insurance

A HomeReady buyer that have an average credit history gets access to home loan cost 0.twenty five commission activities below fundamental antique rates. People with a high credit scores receive costs deal of the as much because 0.75 fee issues.

At exactly the same time, HomeReady deals personal financial insurance having eligible consumers. An average HomeReady citizen pays reduced having PMI and you can conserves hundreds from dollars for the financial insurance a-year.

Just like the Federal national mortgage association offers financial pricing and private mortgage insurance rates, HomeReady homeowners help save doing $700 for each $100,000 borrowed annually compared to the fundamental mortgage borrowers.