Although monitors will be transferred with your cellular telephone, there are several conditions. Most personal, company and you will government checks meet the requirements, however, other dollars alternatives such as money purchases or discounts bonds get never be. Specific financial institutions allow you to set a limit about how far you could potentially deposit on your family savings.

It could take a short time to your transaction getting closed, which “will likely be a shock for teenagers that familiar with economic purchases experiencing instantly,” Maize says. “Checks will need to be endorsed just as they might if the you had been placing him or her inside-individual at your bank,” says Bonnie Maize, a monetary coach from the Maize Financial within the Rossville, Ohio. Safely shop the fresh consider until you comprehend the whole number of the brand new put appear on your account’s directory of earlier or previous deals. If your photographs you’ve removed are blurred, retake them by the slowly moving closer to otherwise further from the newest take a look at it’s inside best interest. The financial you’ll refuse the brand new verify that the pictures are out from focus.

Cellular Take a look at Deposit Benefits

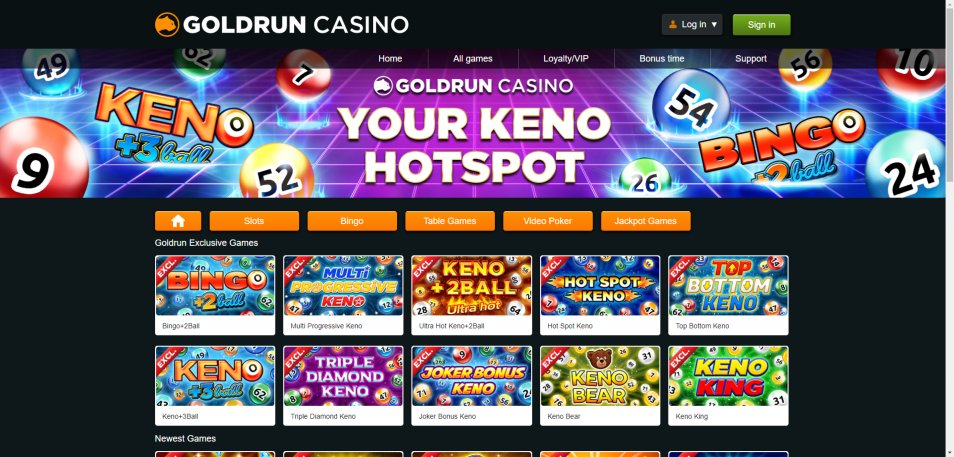

Become familiar with the site regulations and make gambling as simple that you can. As the an alternative punter, you could claim an excellent £fifty totally free wager offer from the bookmaker, incorporating a captivating incentive to help you kickstart their gambling trip. All of our digital tutorials take you step-by-step through the newest software, in addition to subscribe and you can what direction to go for individuals who ignore your username otherwise password. \r\nOur digital lessons walk you through the newest app, in addition to join and you may what to do for individuals who forget about your own login name or code. Understand our very own Ethereum gambling enterprise reviews for the best web site to possess their gambling requires. Terms of service ruling access to ConnectNetwork functions state that the functions are created for use by the individuals over the ages out of 18.

It can be appealing in order to place the new take a look at into the new shredder, but which could cause issues in case your financial features a question about the put. To make sure there are not any problems together with your cellular deposit, bring photos of the sign in a highly-illuminated town and on an apartment surface one to’s obvious and you will black. Make sure that the newest consider are totally inside the frame one to the thing is and that nothing else is seen. You’ll end up being brought to snap a graphic of your top and you may right back of one’s look at. Deposit a check directly into the qualified checking or checking account in just several taps. Mobile take a look at deposit functions having fun with secluded put get tech.

Which have a delicate user interface plus the ease of cellular expenses payments, the platform provides a simple playing sense. Online banks will be enable you to hook up your bank account digitally to another membership during the a timeless bank or borrowing from the bank relationship. If it connected establishment features a neighborhood department, build your bucks deposit here. Next, perform an electronic import, known as an ACH transfer, to go the cash to your online bank. And that have a cover to your restrict deposits, you obtained’t manage to cash-out by using the pay by the cell phone strategy.

Inmates may fund it cellular https://gamblerzone.ca/genesis-casino-review/ phone membership from their commissary/trust membership. The newest put will be paid back after, at the conclusion of the new month, with your typical cellular phone statement. Southern Africa did have a pay-by-telephone system entitled Vodafone mPesa, and several casinos approved they (of many however manage, but just for participants from Kenya and a few other African countries). To the RBC Mobile1 application, you could potentially capture a graphic of the cheque on the cell phone otherwise pill and you will quickly deposit it into the account. ViaPath Deposit Solutions do efficiencies when you take places, keep your charges down, and increase the ease for friends and family participants.

Easy access

And when you lender having an online-merely bank and no physical twigs, cellular look at deposit may be quicker than mailing inside the a. The newest Consider Cleaning to your twenty-first Millennium Act allows financial institutions so you can accept substitute mobile deposit monitors once they’re the brand new courtroom exact carbon copy of an actual physical look at. That’s exactly what secluded deposit capture lets—the brand new replacing of an electronic digital form of your look for a paper one.

PayViaPhone works with the fresh micropayment community, the newest authorities, Ofcom, PhonepayPlus, plus the community trading connection AIME, and one United kingdom based mobile number is backed by PayForit. However, since the financing had been placed and therefore are offered you should scrawl «VOID» along the deal with of your take a look at otherwise better, shred it. Post both sides to their treatment for your own bank to make sure you earn verification that the take a look at might have been properly received. When you get a verification count, it’s best to create you to off however, if some thing happens incorrect. Whether it all of the is pleasing to the eye, swipe the new Slip to Deposit switch to confirm.

For many who’re also logged into your own financial’s cellular app, you should be capable view the deposit restrictions. If not, you can examine your bank account arrangement or contact your lender in order to ask about constraints to have cellular take a look at put. Not so long ago, the notion of “and then make in initial deposit” might’ve intended incorporating some money so you can a pot of gold your hid inside a cave. Quick forward to the present day time and you will … you still needed to bring your report view on the nearby bank branch otherwise Atm. Now you could potentially deposit a straight from your family area within times, because of the cellular deposit feature on the financial’s cellular app. There are many betting internet sites in the united kingdom you to undertake cell phone statement repayments.

Mobile Look at Deposits

- Ensure that the amount registered fits the total amount on your own view, and choose Complete.

- You’d need to redeposit the newest look at, that will increase the wishing go out up to it clears your own membership.

- Now that you have a complete image of the fresh “pros” and you will “cons” away from using along with your mobile, it’s time for you to see how it functions in practice step by step.

- This is a basic that has become questioned when playing on the internet, so make sure that your respective provider confirms so it security to your their mobile phone expenses betting web sites.

- Bojoko helps you to discover all of the betting websites where you can wager using mobile borrowing from the bank.

Consumers also can put bucks during the more step 1,500 Allpoint+ ATMs, in which you’ll end up being energized an excellent $step 1 commission for each deposit, as well as 0.5 per cent of your own put amount. When deposit currency during the an atm, you’ll has a $5,500 every day restriction, along with a 30-time restrict of $7,five hundred. Check to see when you can use your financial’s mobile take a look at put function (otherwise “remote deposit take,” as the service are officially entitled). Of many banking companies and you will borrowing unions, of varying sizes, provide cellular view deposit. How to see if your financial institution now offers mobile view put is to check your financial application or call the financial institution or credit union. If the mobile take a look at deposit is not doing work and also you imagine you’ve complete everything truthfully, there may be an issue with their mobile financial application.

Specific financial institutions’ software capture the picture instead compelling your, which can be useful but also cause problems. For those who have trouble with automobile-bring, make sure that your look at and cell phone are prepared up precisely prior to opening the bank app. Research any additional recommendations out of your lender on the internet or perhaps in the brand new application. Such as, you may need to generate “to possess remote put merely” or were your bank account amount the lower your own trademark.